Government to audit employers defaulting on SHA contributions in bid to boost revenue

Last month, the Health Ministry reported that 18,988,530 Kenyans had registered for SHA, but concerns over its effectiveness persist.

The Ministry of Health has announced that Social Health Authority (SHA) compliance officers will begin conducting random employer audits to track remittance status as part of efforts to boost contributions to the Social Health Insurance Fund (SHIF) and achieve its Sh102 billion revenue target for the 2025/26 financial year.

Health Cabinet Secretary Deborah Barasa revealed that while the scheme is expected to generate Sh101.7 billion in the financial year beginning July, registration and contributions have fallen short of government projections since SHIF replaced the National Health Insurance Fund (NHIF) in October last year.

More To Read

- MPs demand SHA clears Sh10 billion in pending NHIF bills within three months

- TSC confirms shift to SHA cover for teachers from December 1

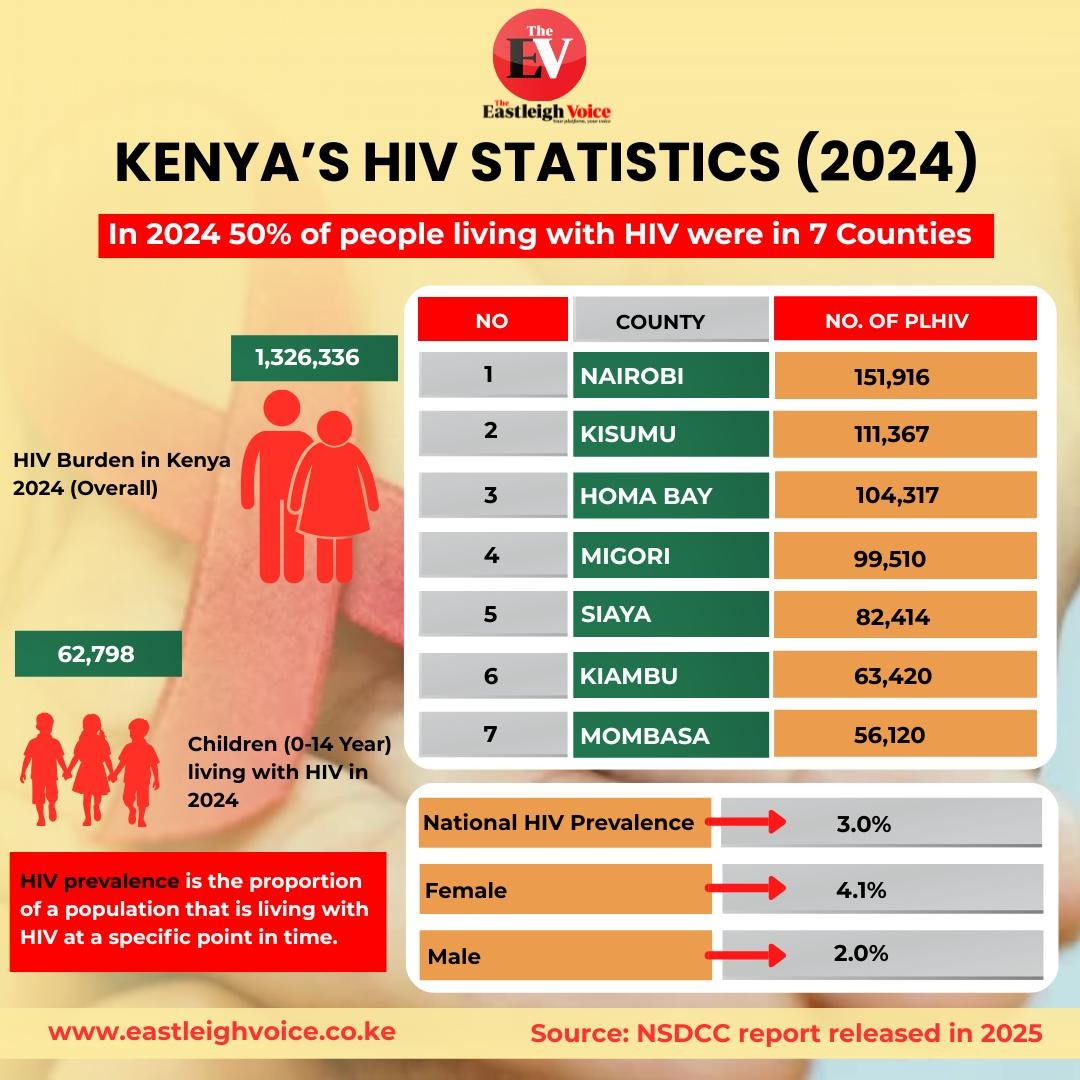

- Young people must lead HIV fight, says PS Ouma Oluga

- SHA transition sparks tension as teachers cite lack of consultation, legal violations

- MPs outline conditions to be met before forests can be degazetted

- Review meeting highlights barriers to immunisation, maternal health in Turkana

In a presentation to the Senate Health Committee on Tuesday, Barasa outlined several other measures aimed at ensuring the SHA meets its revenue target.

She said the government intends to enforce payroll integration with human resource (HR) software providers, including Oracle and QuickBooks, to facilitate automatic deductions.

"We plan to issue circulars mandating employer compliance and linking SHA contributions to pay-as-you-earn (PAYE) deductions," Barasa said.

Additionally, the ministry is also looking to integrate SHA registration with various government agencies such as the Kenya Revenue Authority (KRA), the National Social Security Fund (NSSF), the National Transport and Safety Authority (NTSA), Huduma Namba, and the National Registration Bureau (NRB). This, Barasa noted, will enable "better member identification".

Other strategies outlined by the Health CS include engaging employers through sensitisation sessions, SHA workshops for HR and payroll teams, and sending compliance updates via official corporate emails. She further highlighted plans to use LinkedIn, webinars, and industry roundtables to engage professionals.

The ministry is also considering financial penalties for non-compliant employers while expanding SHA payment channels to include bank payments, agency banking and payroll-linked deductions.

For informal sector workers, Barasa said the government plans to boost registration through community engagement, mass awareness campaigns, and mobile-based registration.

Partnerships with trade unions and co-operatives are also on the table, alongside the introduction of flexible contribution models and mobile banking payment options such as M-Pesa.

To encourage enrolment, the government is proposing targeted subsidies for "the elderly, poor, and vulnerable" and incentives for early registrants.

"This will create a sense of urgency," Barasa said.

Since its rollout, SHA has collected Sh36.8 billion in revenue across its three constituent funds: the Primary Health Care Fund (PHCF), the Emergency Chronic and Critical Illness Fund (ECCIF), and SHIF.

While the first two funds are government-funded, SHIF is solely reliant on contributions from Kenyans. According to Barasa, SHIF alone had raised Sh31.2 billion as of March 15.

Despite these figures, the public healthcare scheme has faced mounting criticism, with many Kenyans complaining about limited benefits and difficulties in accessing treatment despite making contributions.

Last month, the Health Ministry reported that 18,988,530 Kenyans had registered for SHA, but concerns over its effectiveness persist.

Top Stories Today